Inquivix HQ

1-903, 18 Eonju-ro 146-gil,

Gangnam-gu, Seoul, Korea

06057

Welcome to another issue of Inquivix Insights on the South Korean market. There are new market trends such as “showrooming” and “modisumer” becoming popular in several industries catering to consumer demand. Meanwhile, eCommerce platforms are adapting different strategies to survive the high competition in the market. The FTC continues to ensure that advertising remains according to the standards safeguarding consumer interest. South Korean social media trends are changing with Instagram catching up to Naver Band on active user numbers.

1. “Showrooming” Is the Trend for Furniture and Interior

In the Korean furniture and interior market, showrooms have taken a lead in making sales. Online reinforcement is becoming increasingly important to businesses in these sectors this year because “showrooming” has grown popular. Hyundai Livart’s online sales increased by 12.5% in 2021, while Decoview’s internet purchases accounted for 98% of total revenue this January.

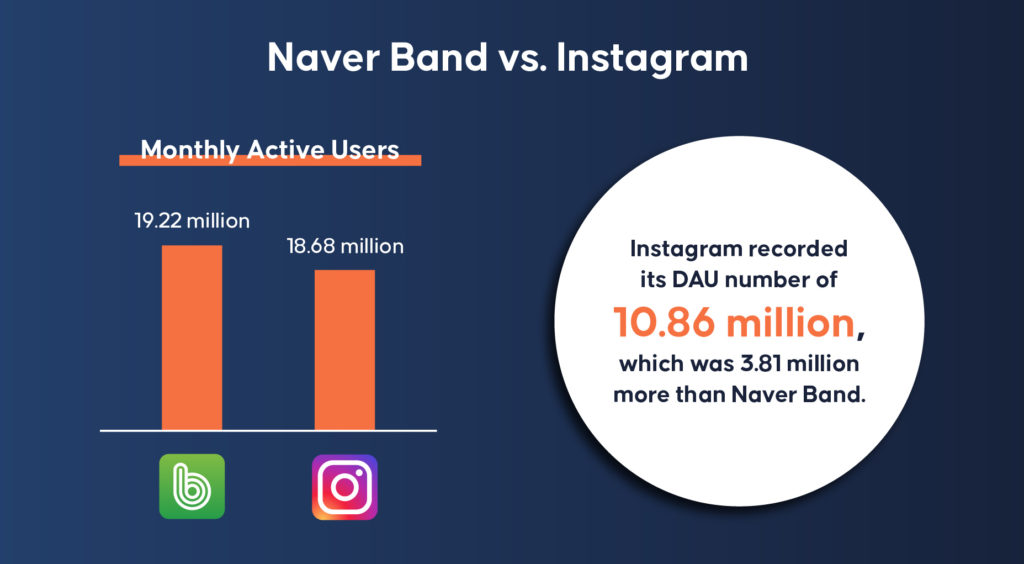

2. Instagram Closes the Gap with Naver on the Number of Active Users

In news about social media trends in South Korea, recently Instagram overtook Naver Band in daily active users (DAU) and narrowed the gap on monthly active users (MAU). The Band’s domestic monthly active users (MAU) rose to 19.22 million, maintaining its No. 1 position in SNS (Social Networking Sites) and community apps. but the gap was only around 540,000 with Instagram’s 18.68 million MAU coming on a close second. In January 2022, Instagram recorded its DAU number of 10.86 million, which was 3.81 million more than Naver Band.

3. Fair Trade Commission Imposes a Fine of 280 Million Won on Eduwill for Unfair Advertising

We previously brought news on the Fair Trade Commission’s investigation on Eduwill, an online education company, for unfair advertising. After the investigation, the FTC has fined Eduwill KRW 286 million for violating the Display Advertising Act. It has also issued a correction order. It was found that the “No. 1 in the number of successful applicants” was only for the 2016 and 2017 real estate agent tests according to the Fair Trade Commission’s survey. In addition, the term “No. 1 civil servant” received based on a 2015 survey was likely to be misinterpreted by consumers.

4. Tmon vs WeMakePrice: Different Strategies for Survival

TMON and WeMakePrice are both developing separate survival tactics. By releasing its beta subscription membership “Subscription Plus,” Timon is anticipated to generate a new source of income. Meanwhile, WeMakePrice intends to increase its profit by offering a fully open platform that links various shopping malls and maximizing vendor and consumer inflow.

5. Zigzag Will Return Small Store Advertising Fees Up to 50%

By June, Kakao Style’s “Zigzag” retail commerce platform will provide a discount of up to 50% on advertising fees for small business owners. This refunding will occur through Zigzag Integrated Payment System. Stores with monthly sales of less than 3 million won will receive a return of 50%. Furthermore, stores with monthly sales between 3 million won to 5 million won will receive a return of 30% of advertising points.

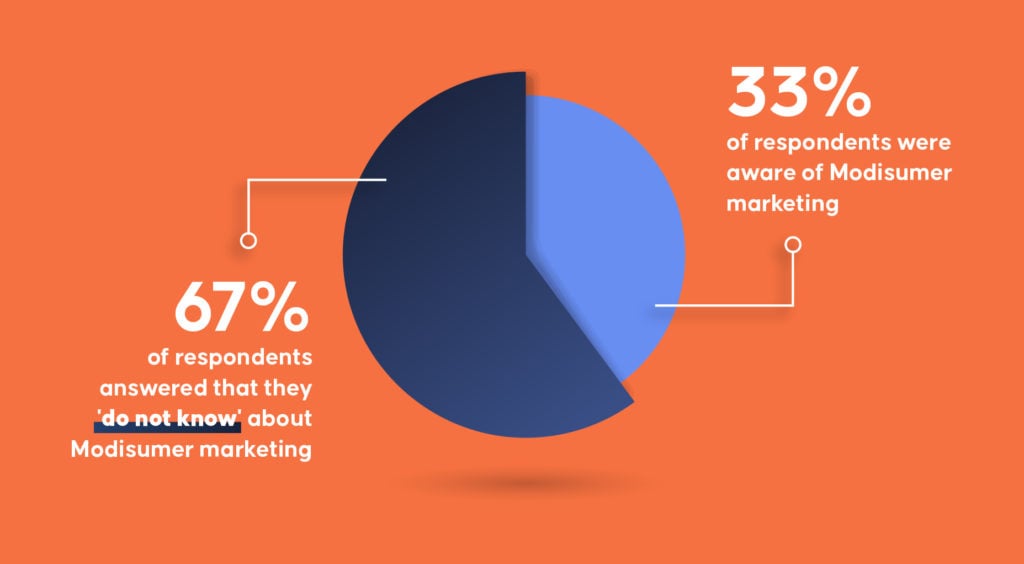

6. Modisumer Marketing Gaining Popularity in South Korea

There’s a new marketing trend becoming popular in South Korea called ‘Modisumer’ marketing. The products are developed and re-launched to meet the demands of clients, which is gaining traction. Many popular food brands have used this method to introduce new flavors or portion sizes. However, it was discovered that less than half of the adult consumers were aware of it. According to the survey conducted, only 33% of respondents were aware of Modisumer marketing. 67% of respondents answered that they ‘do not know’ about modisumer marketing.

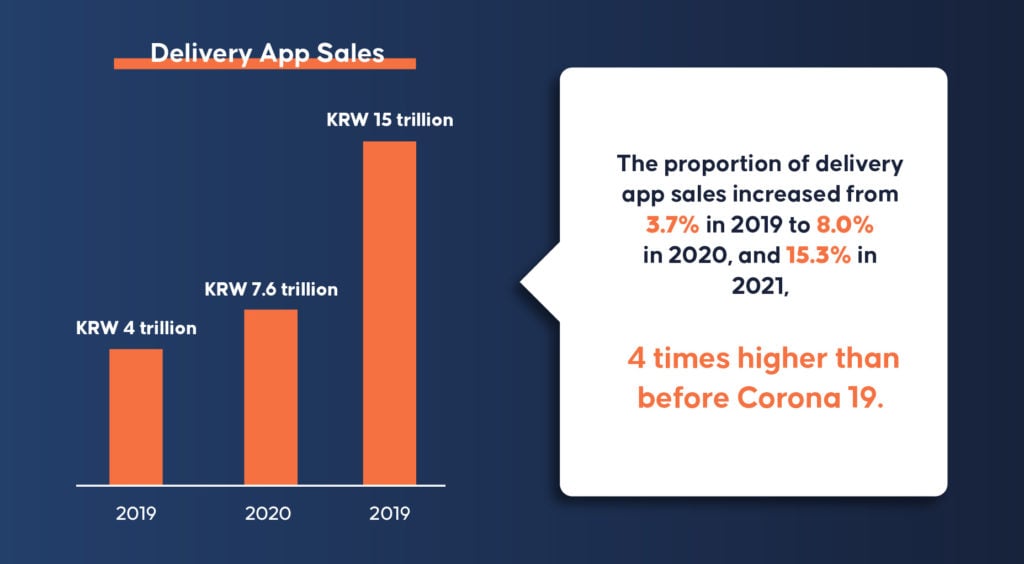

7. The Share of Food Delivery App Sales Has Quadrupled Amidst COVID-19

In the two years since COVID-19 broke out, delivery app sales have more than quadrupled in the restaurant sector in South Korea. Offline sales in the restaurant industry were 85.9 trillion won (84.7%), down 6.6% from 2019, while delivery app purchases rose to 15.6 trillion won (15.3%). Delivery app sales have recorded a continuous increase from 4 trillion won in 2019 to 7.6 trillion won in 2020 and 15 trillion won in 2021. The proportion of delivery app sales increased from 3.7% in 2019 to 8.0% in 2020, and 15.3% in 2021, 4 times higher than before Corona 19.

Restaurant owners, on the other hand, are not entirely pleased with the growth in sales via delivery applications. This is because, despite the fact that sales have risen with the usage of delivery apps, delivery app commissions and advertising expenses have risen proportionately.

Conclusion

The South Korean market is moving ahead with its digital transformation with eCommerce and social media platforms continuing operations while new industries are entering the digital market. The newest addition is the furniture and interior decoration industry which is enhancing its online presence with “showrooming” where consumers can purchase products without visiting stores.

While businesses are changing their strategies, consumer behavior is also rapidly changing in South Korea. Where Naver Band used to be the most popular mobile community app, is now threatened by Instagram. Instagram’s monthly active user numbers are catching up to Naver Band’s while Instagram’s daily active user numbers sometimes surpass that of Naver Band. Another trend in consumer behavior is the increased sales value of food delivery services which has multiplied by four times.